How does the Inflation Reduction Act affect me?

Key Points from Johns Hopkins Bloomberg School of Public Health

- Drug Companies are not allowed to raise their prices faster than the rate of inflation, so this will keep drug prices down.

- The Medicare program can, for a subset of drugs, negotiate the price of drugs directly. And these are drugs that are very expensive and will save billions of dollars in the negotiations.

- In the past, Medicare Fee for Service Beneficiaries have had unlimited out-of-pocket expenses (for drugs), and now they will be limited to only $2,000/year (Starting in 2025).

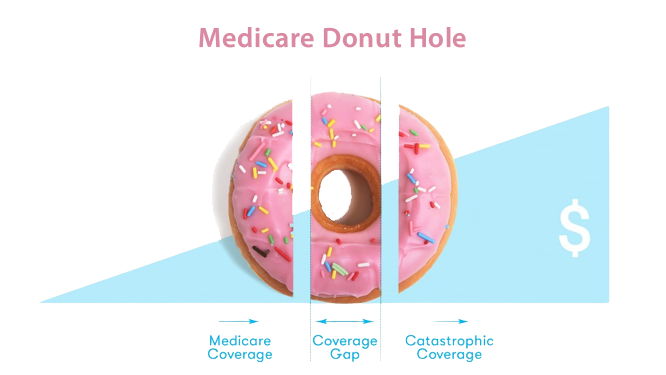

This means Lower part B (doctor) and part D (drug) premiums and substantial savings for Medicare beneficiaries with extremely expensive medications, starting in 2025. This will also eliminate the Coverage Gap (Donut Hole) phase!

In preparation for the $2,000 maximum out of pocket for drug costs starting in 2025, we expect many changes in the 2024 plan pricing. Let us provide a no-cost plan evaluation to determine how this will affect you!

Additional information found here: Inflation Reduction Act Research Series: Medicare Part D Enrollee Out-of-Pocket Spending: Recent Trends and Projected Impacts of the Inflation Reduction Act | Medicare and You Handbook – 2024

The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023. For more information, click Here For information about Part D Premium and Deductible information, click Here